Apple, 1984 Big Brother

Although every time a new product is launched, Apple's retail shops are still lined with the same long queues, and any buzz about it can trigger a collective frenzy of segmenters and scandalous brands on social networks. But there is no doubt that Apple, having lost Steve Jobs, is no longer Apple; today it has become the most defiant 1984 Big Brother it was back then!

Let's turn our attention back to the 1980s.

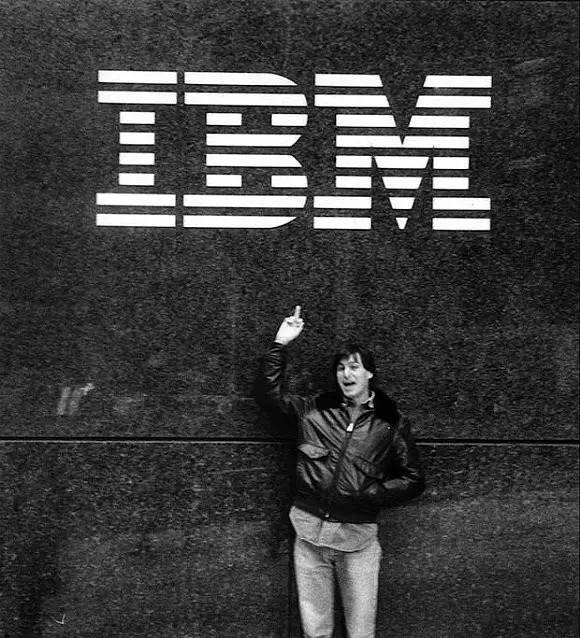

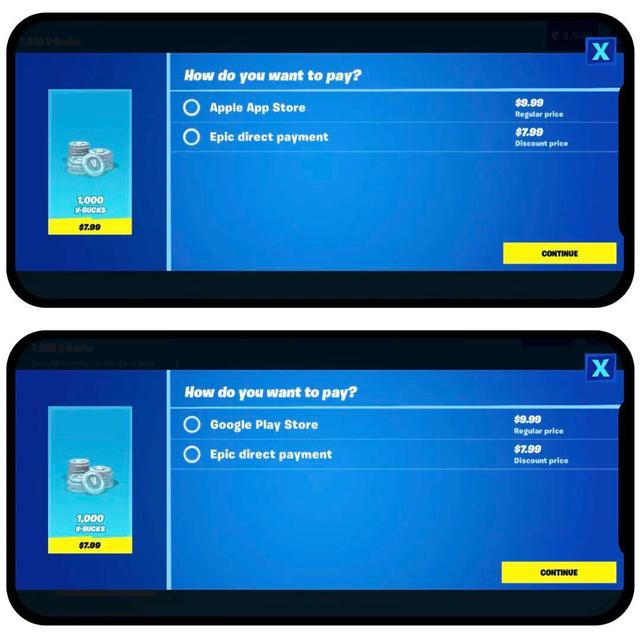

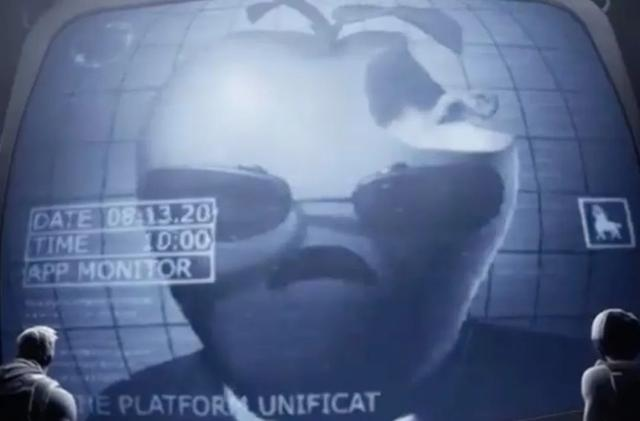

At that time Apple was far from where it is today. In 1984 Apple released the Macintosh, the world's first personal computer with a graphical user interface, a far cry from the DOS command-run IBM. It was a radical departure from IBM, which was running on DOS commands. At the Super Bowl that year, an Apple ad called '1984' came out: a group of expressionless, robot-like, bald men lined up in the lobby and sat to be lectured by their 'big brother' on the big screen. At this point a jock-like woman rushes into the hall and smashes the screen to pieces with a hammer.

Inspired by George Orwell's political satire 1984, the ad represents Apple's ambition to challenge its 'big brother' IBM at the time, with its rebellious, subversive and angry qualities evident.

Steve Jobs later recalled, "Apple, which was a small company at the time, launched the Macintosh, and we wanted to say to the giant of the day, IBM, 'Wait a minute, you're going the wrong way, this is not where we want computers to go, this is not the legacy we want to leave for future generations, this is not what we want our kids to learn. You're going the wrong way, let us show you what's right, which is this machine called the Macintosh, which is so much better than your computers, and it's going to beat you.' That's what Apple stands for.'

Steve Jobs challenges IBM

The 60-second ad, which aired only once at the Super Bowl, created an unprecedented buzz. Once the ad was over, the phones were ringing at CBS, Chiat/Day and Apple, which broadcast the Super Bowl, with most of the calls asking: "What's the ad about? "What is this product?" "Why is there nothing about computers in the 60-second ad?

Jobs later explained: "We wanted to make people ask, 'What is this product? Our idea was to whet people's appetite with advertising, not to introduce the product, to let the world know that Apple had a new product and that it was a big deal.

It was later replayed on all three major US television networks and nearly 50 local stations, and hundreds of newspapers and magazines reviewed the phenomenon and impact of the ad, which was eventually named the greatest commercial of the 20th century by the magazines TV Guide and Advertising Ade. In the 100 days since the commercial aired, Apple has sold 72,000 Macintosh computers.

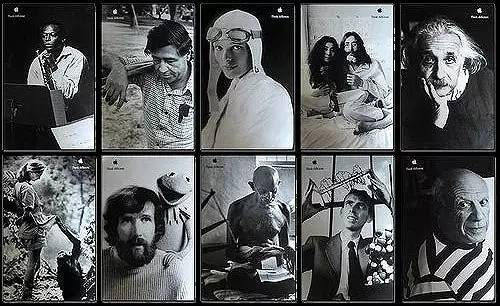

Another classic marketing campaign, 'Think Different', was a rebirth for Apple.

In 1997, it was 11 years since Steve Jobs was ousted from Apple. A series of events struck as a result of misplaced strategic positioning had left Apple on the edge of a cliff - declining market share, a plummeting share price, 25% layoffs and debt ......

The return of Steve Jobs made headlines at a time of life and death. Apple, which had revolutionised personal computing, was at risk of being forgotten, and even those who had followed Apple had become disillusioned. With Jobs back at the helm, the company needed to get the world's attention again and revive the morale that had existed when Apple launched the Macintosh computer.

Normally, when a company is facing a financial crisis, it usually tries to reduce its spending. But Steve Jobs didn't do that, and was willing to invest in reinventing not just Apple's products, but also its image.

At this time Apple needed to appeal to three different groups of people: the first was users who remembered the old Apple but no longer followed its development; the second was a new generation of young users who knew only one Apple - the now sickly Apple; the third group, most importantly, was Apple's employees, who after years of bad news and multiple products that lacked innovation, they were in desperate need of inspiration.

Steve Jobs came up with 'Think Different' and selected icons from various fields of thought who broke the mould, such as Albert Einstein, Hitchcock, Bob Dylan, Martin Luther King, John Lennon, Chaplin, Picasso, Gandhi, Thomas Edison and many more, and put their large black and white portraits in print ads with the Apple logo and tagline in the corner Think Different, with no explanatory text beyond that.

Think Different

The TV commercial 'To the crazy ones' is also in the form of a black and white silent film, and in addition to the Oscar-winning Richard Dreyfuss voice version that aired after the TV premiere of 'Toy Story' and was widely seen, Steve Jobs himself also recorded it once. The lines of this ad, which was made with all of Jobs' passion, describe not only Apple, but also himself

"They are mavericks, they are unruly, they get into trouble, they don't fit in, they see things differently, they don't like to conform and they don't want to settle for the status quo. You can agree with them, you can disagree with them, you can celebrate them or denigrate them, but you can't ignore them. Because they change the ordinary, they move humanity forward. They may be madmen in the eyes of others, but they are geniuses in our eyes. Because only those who are crazy enough to think they can change the world ...... can really change the world."

To the crazy ones

"The 'Think Different' branding campaign, which ran for five years, was the most memorable marketing campaign in Apple's history. It became not only a phrase to describe a company's culture, but also a concept that accurately described all Apple products.

Steve Jobs himself, when presenting the 'Think Different' series of events, expressed the idea that could be the core concept of 'Apple Style' - "For me, marketing is about values," He said.

Steve Jobs used Nike as an example, "Nike sells shoes, yet when you think of Nike, you think of it as different from other shoe companies. People know that Nike's ads never mention price. They advertise respect for great athletes and competitive sports."

So you'll find that Apple's advertising sells not just the product, but the culture behind it - disruptive, innovative, young, maverick - and it cleverly associates the brand with an attitude to life.

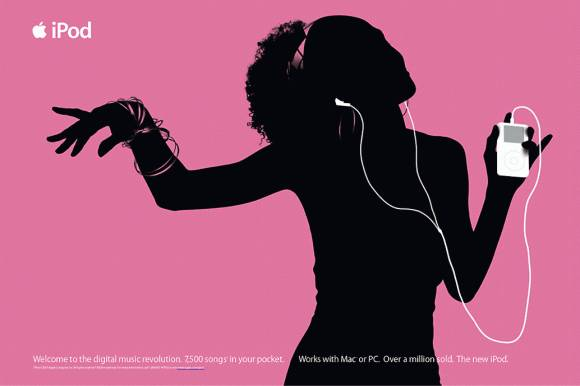

Apple's iPod ad, for example, doesn't showcase a product, it creates an icon; in this 2003 ad, two-dimensional silhouettes of human figures dance against a brightly coloured background; there are no photos of the product in the ad, and the iPod and headphones appear in silhouette. Apple does not ask the viewer to buy the product, but only to identify with the emotion of the ad.

iPod ads

"Steve has created the only fashion brand in the technology industry," commented Oracle founder Larry Ellison, "and people are proud to own certain brands of cars - Porsches, Ferraris, Toyota Priuses - because I drive What I drive says a lot about the kind of person I am. People feel the same way about Apple's products.'

Like the arrogant, rebellious Steve Jobs, who revered madness and genius, Apple's culture was born with a DNA that challenged authority. As well as openly challenging IBM with '1984', in 1985 it launched the more controversial 'Lemmings', a group of people mechanically lined up to jump off a cliff like lemmings, as a satirical reference to corporate PC users.

IBM was not the only one to be provoked, as many major companies of the time were subjected to this 'treatment' by Apple, including Intel, Microsoft and even the computer industry as a whole. Apple launched a series of 66 'Mac versus PC' adverts against Microsoft over a four-year period starting in 2006, bringing the Mac and PC into human form, giving them personalities and using humorous interactions between the two to reflect their differences.

Steve Jobs died on November 6, 2011.

There are often legendary entrepreneurs with unique personalities, but there will never be another like Steve Jobs - one who led disruptive change in a number of industries, including music, animation and computing, while capturing the masses with his charismatic personality and elegant aesthetic.

An article from the Huffington Post titled "Why Apple is doomed" should serve as a proxy for the prevailing market view at the time; in it, VERTU writes

"Jobs' management, and even his vision, is replaceable, but his extraordinary taste is unmatched, and that is precisely the key to Apple's success."

In other words, the capital market's perception of this great company does not diverge from that of the average consumer: Apple's core competency stems from a unique class of product power; and this advantage must be built on continuous innovation and inspiration.

Neither 'innovation' nor 'inspiration' are Cook's specialities. Before Steve Jobs passed away, Cook was primarily responsible for 'operations' at Apple - a function which, given that Apple did not have a dedicated operations department, was in fact all-encompassing, covering everything from upstream supply and manufacturing to sales and distribution. A visual indicator of this is that within his first seven months at Apple, Cook managed to drastically reduce Apple's inventory turnaround time from 30 days to six days; to this day, Apple's supply chain management remains at the top of the industry, with turnaround efficiencies that dwarf those of many FMCG and retail companies that are naturally high-turnaround companies.

But the concepts of supply chain optimisation, lean manufacturing and inventory management sound so dull and boring compared to the achievements of the Steve Jobs times, which saw a steady stream of "cross-genre, exciting and superb products", that investors find it hard to believe that such details can forge a solid moat. From 2011 to 2016, Apple's valuation remained at around 10 times, despite almost doubling both revenue and net profit in the same period.

In 2016, Warren Buffett, the world's best-known investment guru, chose to become a shareholder of Apple Inc.

The investment generated an unprecedented amount of buzz at the time.

On the one hand, the logic of this investment does not look so well understood from the perspective of the investment community: bearing in mind that Apple in 2016, despite its modest valuation, was already the world's largest company from a market capitalisation perspective (US$609.8 billion at the end of 2016), one can hardly imagine how much more upside there could be in the share price of such a giant; at the same time, with the dividend of rising smartphone penetration At the same time, the company is also in an industry that is clearly at an inflection point where growth rates are changing gears (smartphone shipments are about to see three consecutive years of negative growth from 2017-2019).

On the other hand, from a technology point of view, the fact that Apple has been "reduced" to a value investment seems to be another proof of Apple's "lack of innovation". After all, Warren Buffett is known for not investing in technology stocks, and has publicly stated that he understands Apple in the same way as he does consumer goods.

Taking away these preconceptions and the natural fear of large market capitalisation, Apple at the time was indeed a worthwhile bet from a purely quantitative perspective - for less than 10x valuation, shareholders would be getting a great business with a 40%+ gross margin, 20% net margin and 35% return on equity, a A money printing machine that generates US$60 billion + in cash flow per year and only needs to pay around US$20 billion at most to cover its entire capital and R&D expenditure.

As long as this money printing machine can generate shareholder returns, what's the problem with a lower growth rate?

The only "flaw" may be Apple's previous "average" willingness to reward shareholders (in fact, Apple's dividend buybacks from 2014-2016 have reached a high ratio to accounting net profit): the company has more than $200 billion in cash lying on its books, and it has been accumulating more and more every year without giving it back to shareholders. The company has more than $200 billion in cash on its books, and it is accumulating more and more every year, but it is not giving it back to its shareholders.

However, the reason Apple has not given back further to shareholders is not for lack of will, but because it would be very uneconomical to do so - as a company with a global sales network, it would have to suffer a high repatriation tax (at a staggering 35%!) on the cash generated from its sales before it could be repatriated to the US and distributed to shareholders. This is clearly not in the best interests of shareholders.

In 2018, the Trump administration's push for tax reform completely cleared this hurdle for Apple's buybacks. Since the start of 2018, Apple has aggressively ramped up its share buybacks - in fiscal 2018, the company paid out just $13.7 billion in cash dividends while buying back a whopping $72.7 billion; dividends plus buybacks created an actual shareholder return of 145% of that year's profits.

This resulted in a staggering 11% dividend return to shareholders at one point - something that was clearly unsustainable in the low-dividend, highly liquid US equity market; it is therefore no surprise that Apple's market capitalisation topped $1 trillion for the first time in August 2018.

2018-2022: The world sees the power of 'eco'

But if it is just about increasing shareholder returns, without tangible new growth, Apple will probably only be able to generate a valuation fix + a stable dividend yield for investors.

And in the vast business landscape of the Apple empire, one of the key new growth engines has for a long time been like the elephant in the room: so obvious that it has instead become a blind spot in the investment horizon - the great leap forward in the digital economy in the mobile internet times and the inevitability of Apple benefiting as the gatekeeper of a closed mobile ecosystem.

Years ago, when Steve Jobs tried to make iOS a closed "walled garden" and insisted that third-party developers develop software according to Apple's rules and standards, he probably didn't anticipate that Apple's software revenue would one day grow into a $70 billion annual business, but was simply sticking to He was just sticking to his own "end-to-end" product experience.

However, the fact is that the closed ecosystem of the iPhone, unlike that of Android, gives Apple a strong voice and rule-making power over the software services and traffic distributed through the Apple App Store, and in a way makes the bilateral network effect between users and developers even more pronounced.

By 2019, this digital economy ecosystem, of which iOS forms the underlying infrastructure, has reached a staggering $519 billion and is still growing at around 20%. This is created by the tens of millions of developers around the world who develop mobile games and apps for iOS; and through direct draws (30% for regular draws and a reduced rate of 15% for smaller developers), App Store advertising and direct licensing (Google pays Apple up to ten billion dollars a year in licensing fees to become the default search engine for the iPhone), Apple earns tens of billions of dollars in internet revenue.

Like all internet platform companies, this revenue is extremely gross and again has almost no marginal cost; unlike internet platform companies, the underlying operating system and app shop are at the beginning of the mobile app market's traffic, without any competitors.

In fiscal 2018, Apple's services revenue reached 15% of total revenue for the first time; in fiscal 2020, Apple's services revenue exceeded 20% of total revenue for the first time. The tangible revenue structure changes have given a growing audience to the valuation logic that "Apple's service revenue deserves to be revalued". From 2019 onwards, Apple's valuation pivot has risen from 10x to around 15x; with the Fed's continued "easing" since the outbreak in 2020, the continued decline in risk-free rates has raised Apple's valuation pivot further to over 25x. After a brief crash in March 2020, Apple quickly recovered its losses and exceeded $2 trillion in market capitalisation for the first time in August.

In 2021, Apple delivered one of its best annual reports ever: revenues of US$365.8 billion, up 33% year-on-year, and net profit of US$94.7 billion, up 64.9% year-on-year. The return on net assets for the year was a staggering 147%, and after completing a dividend buyback of over $100 billion, there was still $65.8 billion of net cash (cash - interest-bearing debt) left on the books. In this statement, in addition to the still fast-growing services revenue that continues to exceed expectations, the wearable and smart home devices division, represented by iWatch and AirPods, has grown into a $35+ billion annual revenue business, not to mention the MaC division, which has started a comeback to Windows after years of silence.

At today's scale, Apple is a company that cannot be evaluated from a purely commercial point of view, it has become a mega-monster no less than a medium sized country! The most direct example of this is its IOS garden, where everyone from tech giants to ordinary developers have complained about Apple's arrogance and opaqueness in its distribution, in-app payment (iAP) and App Store policies, and developers and consumers alike have been "Apple-taxed" for so long that it has become a giant brother countless times larger than the IBM it rebelled against.

On 17 August 2020, Apple announced that it was withdrawing Epic Games from all developer status on iOS and macOS and removing its products from Apple Developer Tools. This means that other third-party developers will then not be able to develop using the Unreal engine developed by Epic Games, the developer of the famous game Fortnite.

I should say that this incident illustrates on a considerable level why Apple has become Big Brother!

First let's review what has happened in chronological order.

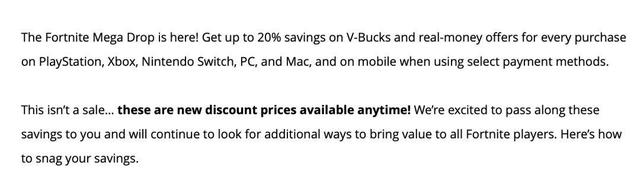

On the morning of August 13, 2020, Epic Games updated the iOS and Android mobile game clients for Fortnite (hereafter Fortnite) and went live with a pretty intense promotion that offers 20% off cash recharges across desktop, mobile and console platforms.

Fortnite has also added a way to pay directly to Epic Games on the dual mobile platform, dropping the price from $9.99 to $7.99 for players to top up their Battle Pass, also known as a premium membership.

When recharging, two options are thus placed directly in front of the player: theNot only does Epic Games compare the price difference between the two payment methods in a straightforward manner within the game, it also explains the reason for the difference directly in its press release: Apple charges a 30% fee on in-app payments, or what we often refer to as the "Apple Tax".

As a result, on the afternoon of 13 August, Apple pulled Fortbite from the App Store in a surprise move.

"Today, Epic Games unfortunately took the step of violating the App Store Guidelines by treating all developers the same. As a result, the Fortbite app has been taken down and Epic Games has enabled a feature within its app that was not reviewed and approved by Apple, and which was done with the express intent of violating the App Store Guidelines for in-app payments."

Almost simultaneously with the iOS drop, Epic Games released a video satirising the way Apple has become what it once loathed back in the day. The clip, titled Nineteen Eighty-Fortnite, spoofs the original Apple commercial, 1984:.

The "Big Brother" in the original film becomes Apple itself in this video.

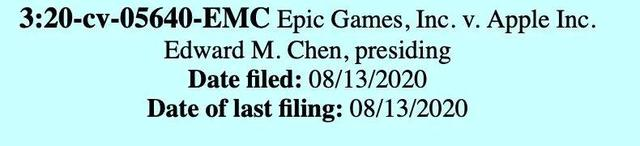

At the end of the video, Epic Games invites players to join the movement to "Free Fortnite" (#FreeFortnite): "Epic Games is rebelling against the Apple App Store monopoly. Join us in the fight and don't let 2020 be '1984'." Within an hour of Fortnite's iOS removal, Epic Games filed a formal civil monopoly lawsuit against Apple in the U.S. District Court for the Northern District of California, Case No. 3:20-cv-05640.

The indictment is 62 pages long - it's clear that this is a long-planned revolt ......

The indictment, which brings forward a total of 10 counts, lists many of Epic Games' allegations against Apple, including, inter alia.

- Apple's illegal monopoly on the iOS app distribution market.

- As the owner of the iOS operating system, Apple refuses to open access to other developers who want to offer app distribution services on iOS (alongside the App Store).

- Apple has cornered the market on how iOS in-app purchases are paid for and denied other companies the opportunity to innovate on how iOS in-app purchases are paid for.

As a result, Apple has absolute control over the entire market chain, from the operating system, to the distribution of apps, to the way in-app purchases are paid for, and is in a monopoly position to profit from this.

The world is never short of people who resent Apple's 30% cut, only developers who are brave enough to take Apple on publicly.

After all, you and I both know that - on iOS, Apple rules supreme. It can take down your product at will, wipe out years of developer work, and give you no explanation.

Suing? Even if you don't care about winning, but just want a result, I'm afraid that few companies are strong enough to fight Apple in court. In the past few years, only major technology companies of the magnitude of Amazon and Netflix have been able to get to the "negotiating table" with Apple and get them to give up a small percentage of their draws.

The core concept of Web 3.0, on the other hand, lies in decentralisation.

Although Amazon, Google, Microsoft and Meta are the four centralised Internet giants, there are gradations of centralisation, and cloud giants such as Amazon also promote the 'distributed philosophy'. Most cloud giants have chosen to locate their servers in multiple locations, agreeing that "absolute centralisation is extremely risky".

More crucially, all four of these tech giants have found a business fit with Web3 and have explored greater business opportunities as a result, so rather than rejecting it, they have chosen to embrace it aggressively.

In contrast, Apple seems to be inherently "out of step" with Web3. Due to the closed nature of its iOS system, almost all mobile-related innovations in the Web3 space have been biased towards Android rather than iOS.

Common sense would have us think of public chains as Amazon AWS and other such cloud databases, while wallets are the equivalent of operating systems and DAPPs are the equivalent of apps.

The difference is that public chains and AWS are not in direct competition with each other, even though they are both databases; and while wallets are equivalent to operating systems, Web3 wallets and Android are not in direct competition either; the only ones that are in some direct competition are DAPPs and APPs, as the number of users and time is relatively fixed. But APPs such as Facebook, Instagram and Twitter have all found a nexus with Web3, creating a close relationship that is both competitive and collaborative.

It would seem that Web3 is indeed at odds with Apple in every way, if not in every way.

The birth and core philosophy of Web 3.0 seems to have inhibited Apple's expansion at every turn, knocking on the closed walls of Apple's iOS system and making Apple even more "disgusted" with Web 3 as a technology.

But, development moves forward and does not flow against the tide.

If we go back to the glory days of the Internet in the 1990s, did the group of adventurers and geniuses who ventured into Web 2.0 imagine and expect the same things from Web 2 that you and I expect from Web 3 today?

Our imagination of the creator, our desire for discovery and innovation, has begun again with Web3, or perhaps it has never stopped. It's just that the hammer from 1984 may not be lifted by Apple this time.

In the face of the Web 3.0 world, Apple, which is reluctant to step into it, might as well pointedly question.

- Are there any scenarios that cannot be done on the iPhone and must be done in Web3?

- If so, how many people need the Web3 product in this scenario?

- Will the Web3 product solve problems more efficiently than the iPhone in this scenario?

If you were an Apple executive, what would your answer be? The answer may be different, but there is only one result of stagnation.

As Nokia's Jorma Ollila said in 2013 - "We didn't do anything wrong, but somehow we lost."

Ten years have passed in a flash, and the world has not stopped turning even more.

It stands to reason that Web2 is moving towards Web3, that a new times is once again upon us, a new times of people connecting with information and people connecting with people in new ways has begun!

Fifteen years ago, Steve Jobs ushered in the times of APPs, and there was a boom period when APP creators and user sizes were short-lived, with all kinds of APPs blossoming on both Android and Apple platforms. But then the major internet giants began to frantically develop their own cutthroat forces, keeping users firmly within their own apps, refusing to connect or interact with each other, not allowing users to jump between each other within the app, and even third party developers were similarly restricted.

Looking back today, I wonder how many of these third party clients, developed using APIs, were extinguished by the closed nature of the platform after a few moments of glory? And when the platform became "pure", the people who raised the hammer became the ones who got cracked in 1984 ......

On a practical level, this has been a success, with the giants making huge amounts of money and allowing their market capitalisation and share prices to 'soar'. It has also been proven that the ban on users is effective, but the rules of the game have changed, and after the users have been divided up, the only thing left is for the giants to compete with each other for users.

So there you have it, the situation you and I are facing today: the giants have launched products or services that are more addictive and time-consuming for users. It has become an insurmountable zero-sum situation, where your gain is my loss and vice versa.

It also means that neither of them dares to let go first, and neither is willing to give up the ground they have today to enter Web3 in a truly righteous manner.

Look at the products Apple has launched in the last 5 years, all of them are a shadow of their former selves, is there any trace of Steve Jobs' innovative and revolutionary style? The trillion dollar market capitalisation, supported by Warren Buffett, proves the value of its capital, but it also proves that it has long sold its soul to Wall Street, the dragon slaying boy of the year, properly possessed by the evil dragon.

But how similar is this scene to that of Nokia back in the day?

Looking back at the great 1990s, we can likewise ask three questions.

- Are there any scenarios that can't be done in real life and must be done online?

- If so, how many people need the web product in that scenario?

- Is this scenario better for the efficiency of the web product in solving the problem?

No one knows that the generation that decided to enter the world of the Internet didn't enter the new world for these three questions either. If they had known the answers, they would not have started a bunch of BBS and literary websites. It is doubtful that the first natives who entered the Internet world in the first place would have even considered such questions; there were far too few intelligent people among them, probably made up of 90% of the socially marginalised and idle, 9% of the adventurous, and 1% of the truly talented. Their initial intentions were not complicated, it was enough to have a world outside of real life, in which they were free to do what they wanted to do, to be able to achieve the dissemination of information and the connection of people across geography and time.

It is the same now, people who are stubbornly asking and answering questions, people who cannot be open to the unknown and innovation, are people like Yoma Olila of Nokia back then, who can cope with life now, handle all the business and fulfil all the KPIs with aplomb.

Yes, KPI!

It may not be possible to touch the new world or have the courage to enter it as long as the KPIs can be met.

Apple executives can certainly ask people in the Web3 mobile industry with great arrogance: what is the value of everything you do, how many people will use it, and is it better than what the iPhone is doing now?

Do we need to answer these questions? No!

We have seen a crack in the cramped, involute world, leading to a world where the rules of the game are redefined by ourselves, once again, interpreting freedom.

Believers see the light in the crevices of the clouds, let those fruitcakes still worship this wobbly altar! They are kept in the beautiful garden of iOS without knowing it, they are at ease in the cage of their big brother in 1984, they think that Steve Jobs in heaven is gently touching them, they even think that 12mm thick slab is called beauty, they are willing to carry the "bath bar" around with them whenever and wherever they want, they can even happily charge their phones three times a day as their lunchtime and evening classes. Charging three times as their lunch and evening classes ......

The darkness has returned.

That's all they are, they are what they are.

The new world does not belong to those who have succeeded in it; the new world must belong to those among us who seem less intelligent, the hard-headed among us, the reckless adventurers, and the mad geniuses.

Perhaps we are "cannon fodder", because as a result of trying new things, most of the time these attempts fail and so we are destined to be cannon fodder.

But, as history is full of people like us, who have come and gone before us, and who are pervasive, there are always small probabilities that events will occur which will in turn change the entire course of human history.

It's a rebellion against our Silicon Valley predecessors in the same way that Steve Jobs threw the hammer at IBM in 1984.

The endgame is coming.

This is a faith that belongs to us!